Online Investment Clubs: Your Path to Profitable Investing

Ready to pool resources and collectively grow your wealth? An online investment club offers a collaborative approach to investing, combining individual expertise and minimizing individual risk. This guide provides a step-by-step approach to building a successful and legally sound online investment club. Are you ready to take control of your financial future? For insights into emerging investment areas, check out this guide on crypto investment.

Step 1: Building Your Investment Team

First, assemble a team of like-minded investors. Consider friends, family, colleagues, or even online investment communities. The ideal team offers a diverse range of skills and perspectives, fostering balanced decision-making. What's more important than shared financial goals? Complementary expertise. A team with varying strengths in areas such as financial statement analysis and market trend identification is poised for greater success.

Step 2: Establishing a Strong Legal Foundation

Before investing, establish a clear legal structure. Consider forming a Limited Liability Company (LLC) or a partnership to define responsibilities and limit personal liability. Consult with a legal professional to navigate regulations and ensure compliance. Why is having a lawyer crucial? It's a small investment that could prevent significant future legal issues. This step protects your personal assets and provides a solid framework for your club's operations.

Step 3: Defining Your Investment Strategy

Before making any investments, create a comprehensive investment strategy outlining your goals and risk tolerance. What types of investments will you pursue (stocks, bonds, mutual funds, etc.)? This shared understanding is crucial for long-term success. How will your club decide what to invest in? A well-defined, documented strategy ensures everyone is on the same page. This strategy serves as your roadmap, guiding your collective decisions and minimizing potential conflicts.

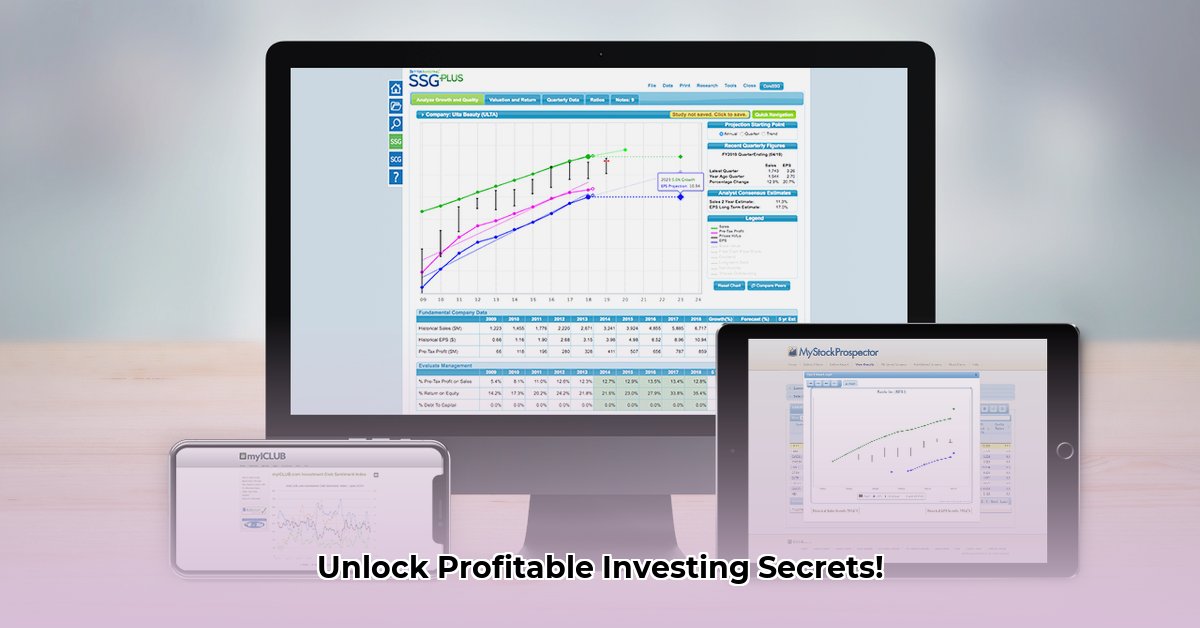

Step 4: Selecting Your Online Platform

Choose an online platform designed for investment clubs. Consider factors such as communication features, investment tracking capabilities, and transaction efficiency. Numerous options, both free and paid, are available. What are the key features to look for in the right platform? Security, ease of use and transparent record-keeping are paramount. The right platform streamlines operations and enhances transparency.

Step 5: Implementing Transparent Accounting

Establish a rigorous accounting system that tracks all contributions, expenses, and profits. Transparency builds trust and minimizes misunderstandings. How can you maintain accountability and prevent disputes? Meticulous record-keeping of every transaction is essential. Regular reviews of financial records foster trust and ensure everyone understands the club's financial position.

Step 6: Fostering Open Communication

Regular meetings and open communication are essential. Leverage your chosen online platform to share insights, discuss investment opportunities, and make collaborative decisions. How often should your investment club meet? Consistent communication is more important than a rigid schedule. Active participation and open dialogue enhance decision-making.

Step 7: Implementing Robust Risk Management

Develop a thorough risk management plan to mitigate market fluctuations and potential losses. Diversify your investments, set stop-loss orders, and establish procedures for handling unexpected events, like market downturns or member withdrawals. How can your club manage risks effectively? A safety net is crucial; it minimizes losses and builds confidence. This proactive approach safeguards your investment and ensures financial stability.

Weighing the Pros and Cons: Is an Online Investment Club Right for You?

Before proceeding, consider the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Shared expertise and reduced individual risk | Potential for disagreements on investment strategies |

| Collaborative decision-making | Requires active participation from all members |

| Access to resources and online tools | Legal and regulatory complexities |

| Potentially higher returns | Risk of member withdrawal leading to disruption |

| Enhanced financial literacy | Needs clear communication channels and robust accounting systems |

How to Legally Structure Your Online Investment Club

Key Considerations:

- Legal Structure: Choosing the right legal structure (LLC, partnership, corporation) impacts liability and taxation. Consult a legal professional.

- SEC Regulations: Understanding and complying with SEC regulations is paramount to avoid penalties. This involves determining whether your club's activities are considered securities.

- Operating Agreement: A comprehensive operating agreement is essential for managing member expectations and potential disputes. This agreement should include clear guidelines for decision-making, investment strategies, and conflict resolution.

- Online Platform: Select a secure and user-friendly online platform that facilitates communication, record-keeping, and transactions.

This guide provides a foundational framework. Remember to seek professional advice from legal and financial experts to ensure your online investment club is both successful and legally compliant. Ready to begin your investment journey?